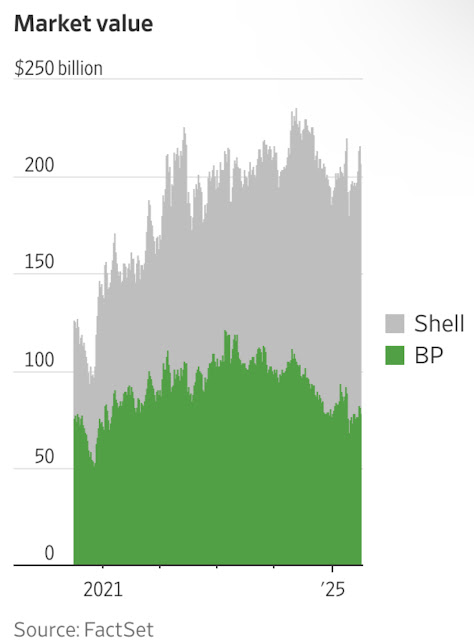

@WSJ reports talks are active, with BP “considering the approach carefully.” The industry has its doubts a deal will be done. Acquiring BP would put Shell more on par with its larger US competitors Exxon Mobil XOM & Chevron CVX.

Pages

▼

Wednesday, June 25, 2025

Tuesday, June 24, 2025

Monday, June 16, 2025

Is the US Handing Over Venezuela’s Oil Sector to China on a Silver Platter?

Following the reimposition of sanctions on Companies operating in Venezuela, Reuters has already reported that crude that was produced in joint ventures with Chevron has been on its way to East Asia…The only problem is how much PDVSA gets paid, when there is only one buyer on the block—a monopsony.

It is unlikely Chinese companies will be taking over Chevron's operations in the near to medium term. More than anything else, because it does not need that to happen for Beijing to expand its influence and control— ditto for Moscow or Iran.

First, investors have plenty of options before them, from greenfield opportunities to mature fields that only need repairs. Venezuela has thousands of square kilometres with billions of barrels of oil underneath. And most joint ventures are effectively dormant: just 20 out of 64 areas of operation are producing more than 10,000 barrels per day of crude, while most are stuck at 0 or below the 1,000 mark.

Second, regime officials will prefer to keep the fields where Chevron invested for themselves. 240,000 barrels per day is a great business opportunity. This means millions of dollars in contracts for goods and services, that used to be managed by a foreign corporation—not anymore, courtesy of President Trump.

Read the whole article on OilPrice.com here:

___________________