How are these two announcements linked and why was it so important that the National Assembly quickly designated a new board of CITGO? In order to answer that, we need to provide some background.

The menaces of the recent past

As shown below, PDV Holding is the parent company of CITGO Holding and CITGO Petroleum Corporation, owners of several assets in North America including the following: three refineries with a combined processing capacity of 750,000 barrels per day (bd), 48 terminals, nine pipelines, over 5,500 independent retail stations in 29 U.S. states, as well as other transport and storage facilities. As of 2015, the company reported an estimated equity value for CITGO Holding (net of debt) of $8.5 billion, and more recent estimates put the value of the company between $4 billion and $8 billion, making this subsidiary PDVSA's most valuable asset abroad.

Problem is that this asset is at risk of being taken out of Venezuela's hands. First, as explained by Daniel Urdaneta here, 50.1% of CITGO Holding's equity was pledged as collateral for PDVSA bonds expiring in 2020 (USD 2.5 billion), and the remainder was used as collateral for USD 1.5 billion loan to Rosneft. Daniel also explained that there are other bonds that could potentially provide a claim to those bondholders over CITGO assets.

The second group of interested parties is related to companies making claims against Venezuela for damages relating to expropriation. The mining firm Crystallex, as well as others such as ConocoPhillips and Owens Illinois are included in this group. Even though some of these claims were against the republic and not specifically targeted at PDVSA, there is now a precedent that opens the possibility for these companies to claim equity in CITGO. A federal judge in Delaware ruled in August 2018 that Venezuela's discretionary control of PDVSA rendered the company the "alter ego" of the government.

In other words, the two entities are one and the same, and therefore, the assets of one could be used to pay the debts of the other. In a report from September 2017, legal experts estimated that Venezuela's exposure to these claims was around $16 billion. This means that even if we don't consider other possible claims coming from other bondholders and companies, the value of CITGO assets will not cover all claims. To put it simply in Caribbean Spanish: "no hay cama pa' tanta gente".

....

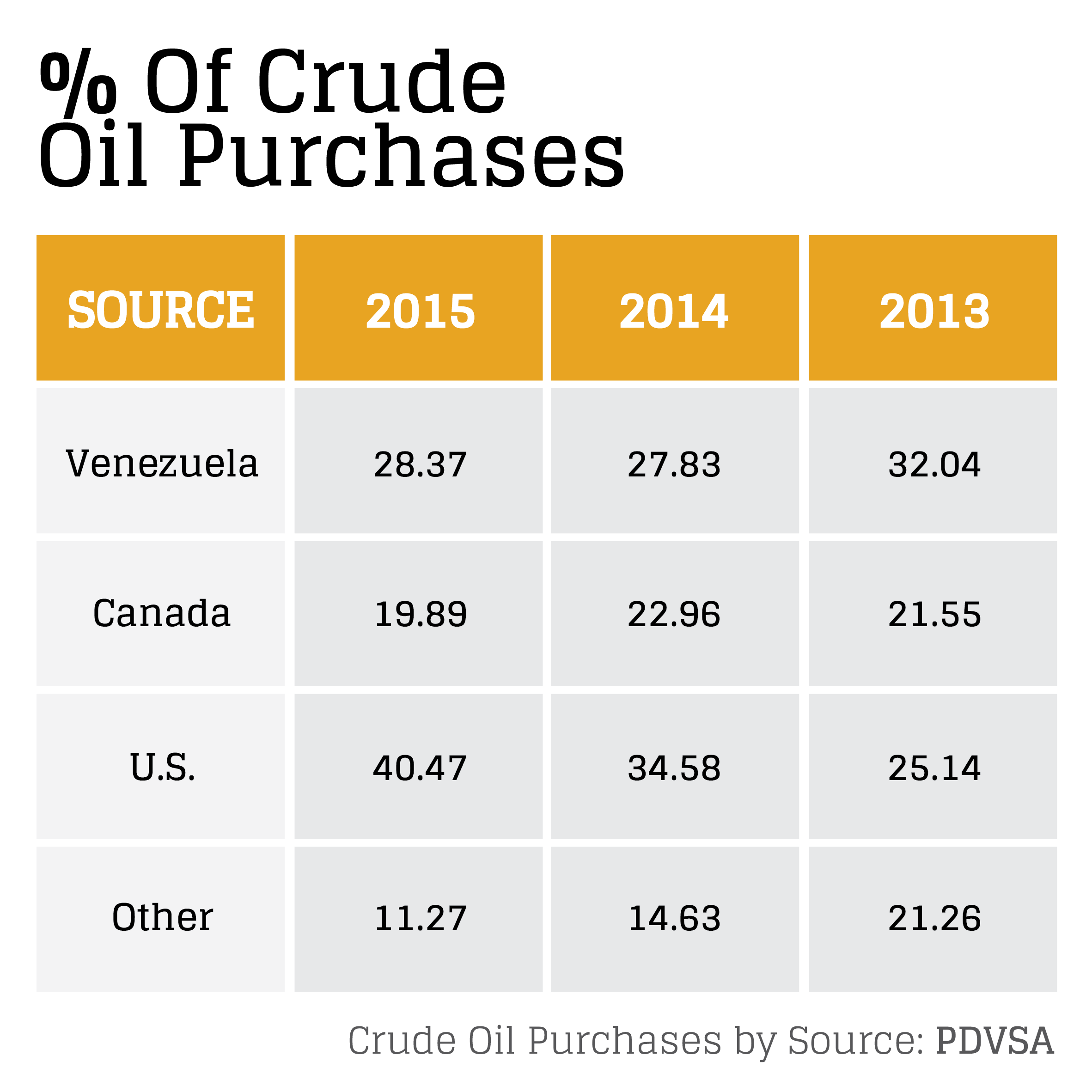

As you can see in the chart, by 2015, approximately 28% of CITGO crude oil purchases (imports and local purchases in the U.S.) were coming from PDVSA and PDVSA affiliated suppliers (CITGO Petroleum chairwoman Luisa Palacios also mentioned similar numbers on March 12th at CERAweek, one of the most important conferences in the energy sector worldwide). The increasing share of the U.S. is due in great part to the increase in supply coming from hydraulic fracturing in this country, reducing the need to import light crude.

See the whole post here: https://www.caracaschronicles.com/2019/03/17/taking-over-citgo-is-the-key-for-the-future/?mc_cid=63dff9440e&mc_eid=ba21069e8b

No comments:

Post a Comment