|

Having to take a loss or relinquish unpaid debt has not stopped companies like France's TotalEnergies, Norway's Equinor, and Japan's Inpex from leaving. Their departure illustrates how US sanctions on the energy sector have made operating in the country with the most crude reserves untenable, leading to idle oilfields.

Venezuela's oil partners head for the exit, forgoing unpaid debt

CABIMAS: Venezuela is allowing partners in state oil company PDVSA's joint ventures to leave - by selling their shares to others or returning them - so long as they forgo payment for past debts and unpaid dividends, four people close to the matter said.

Having to take a loss or relinquish unpaid debt has not stopped companies like France's TotalEnergies, Norway's Equinor, and Japan's Inpex from leaving. Their departure illustrates how US sanctions on the energy sector have made operating in the country with the most crude reserves untenable, leading to idle oilfields.

Eight foreign companies among PDVSA's 44 joint ventures have transferred or given up stakes since 2018. Another seven smaller firms no longer have a presence in Venezuela and 15 projects are inactive, even though those partners technically remain, an internal PDVSA document seen by Reuters showed.

"None of those stakes are recoverable at book value," said an oil executive whose firm left Venezuela by selling to a another company last year. "Among those remaining in the partnerships, few hope to ever recoup pending dividends or commercial debts from PDVSA."

More than three years of harsh US sanctions on PDVSA have restricted access to capital and cashflow and have limited the markets receiving Venezuelan oil, taking a toll on the mostly foreign minority stakeholders, their operations and workers.

Since TotalEnergies and Equinor in 2021 exited one of Venezuela's flagship oil upgrading projects, Petrocedeno, smaller firms have followed.

The French company reported a loss of $1.38 billion from transferring its 30% stake to a PDVSA unit. It received "a symbolic amount" for its assets, Chief Executive Patrick Pouyanne said at the time.

The transfer freed Total of past and future liabilities from its Venezuela projects. But dividends and debts owed by Petrocedeno to the partners also were wiped out, two people familiar with the matter said.

Inpex last year sold stakes in two Venezuelan assets to private equity firm Sucre Energy Group, and returned a stake in a third project to PDVSA. Accounts receivable and owed dividends were transferred to Sucre as part of the transaction, but at a heavily discounted value, a person involved in the transaction said.

The departures highlight the risks of doing business with cash-strapped PDVSA and the few legal avenues available to companies that have not been paid.

Equinor declined to disclose details of the transaction, but confirmed in an email the company has no remaining activity in the country. Inpex, Total and PDVSA did not reply to requests for comment.

WHAT ABOUT THE WORKERS?

Some companies losing staff in Venezuela or dealing with labor claims, including Venezuelan oil firm Suelopetrol and GPB Global Resources, have discovered PDVSA appointed new joint venture managers or took over their operations.

GPB Global Resources, a minority stakeholder in the Petrozamora joint venture, in September lost access to its fields with no official explanation given by PDVSA, sources and workers said.

"They left without paying us completely," said a worker from Petrozamora who asked not to be identified, referring to GPB. "Days ago, an official passed by and said the company had not respected its contract with PDVSA."

Suelopetrol declined to comment on talks with PDVSA, but said the company remains committed to Venezuela, with assets and staff in place. GPB Global Resources did not reply to a request for comment.

With companies and workers leaving almost en masse, the abandonment of oilfields is visible near Maracaibo Lake, among Venezuela's oldest producing region. Its oil output keeps falling, outages became routine and some workers are on the verge of starvation.

"A month ago, they tried to restart a small rig and it caused an explosion than sent crude to people's houses," said a neighbor of Maracaibo's Cabimas oilfield, his feet stained with oil.

From over 110,000 workers a decade ago, PDVSA's workforce has dropped to about 60,000 people, said Daniel Delgado, a union leader at the Tia Juana oilfield.

"We are risking our lives to get an oil barrel out by working in unsafe conditions, without proper equipment or medical assistance. It's a high price," Delgado said.

Between 2019 and 2021, PDVSA delivered oil cargoes to partners to reduce outstanding debt.

Eni and Repsol this summer received 3.6 million barrels in a temporary resumption of oil-for-debt, but nothing since then. Chevron has proposed to the US government it be allowed to recoup its debts through an expanded license, yet pending.

"Almost none of the companies that have left the country have been given that benefit," said an oil industry representative, who declined to be identified.

The departures have hit oil service providers and contractors the hardest, said the Venezuelan Petroleum Chamber, whose members fell to 300 from 500 in the last four years.

Venezuela last year fell short of reaching its oil production goal. And so far this year output has stalled at about 725,000 barrels per day (bpd), well below its year-end target of 2 million bpd.

To further increase production would require PDVSA to honor past debts, said Enrique Novoa, the Chamber's president, adding: "Sanctions also must be eased, at least partially."

Having to take a loss or relinquish unpaid debt has not stopped companies like France's TotalEnergies, Norway's Equinor, and Japan's Inpex from leaving. Their departure illustrates how US sanctions on the energy sector have made operating in the country with the most crude reserves untenable, leading to idle oilfields.

Eight foreign companies among PDVSA's 44 joint ventures have transferred or given up stakes since 2018. Another seven smaller firms no longer have a presence in Venezuela and 15 projects are inactive, even though those partners technically remain, an internal PDVSA document seen by Reuters showed.

"None of those stakes are recoverable at book value," said an oil executive whose firm left Venezuela by selling to a another company last year. "Among those remaining in the partnerships, few hope to ever recoup pending dividends or commercial debts from PDVSA."

More than three years of harsh US sanctions on PDVSA have restricted access to capital and cashflow and have limited the markets receiving Venezuelan oil, taking a toll on the mostly foreign minority stakeholders, their operations and workers.

Since TotalEnergies and Equinor in 2021 exited one of Venezuela's flagship oil upgrading projects, Petrocedeno, smaller firms have followed.

The French company reported a loss of $1.38 billion from transferring its 30% stake to a PDVSA unit. It received "a symbolic amount" for its assets, Chief Executive Patrick Pouyanne said at the time.

The transfer freed Total of past and future liabilities from its Venezuela projects. But dividends and debts owed by Petrocedeno to the partners also were wiped out, two people familiar with the matter said.

Inpex last year sold stakes in two Venezuelan assets to private equity firm Sucre Energy Group, and returned a stake in a third project to PDVSA. Accounts receivable and owed dividends were transferred to Sucre as part of the transaction, but at a heavily discounted value, a person involved in the transaction said.

The departures highlight the risks of doing business with cash-strapped PDVSA and the few legal avenues available to companies that have not been paid.

Equinor declined to disclose details of the transaction, but confirmed in an email the company has no remaining activity in the country. Inpex, Total and PDVSA did not reply to requests for comment.

WHAT ABOUT THE WORKERS?

Some companies losing staff in Venezuela or dealing with labor claims, including Venezuelan oil firm Suelopetrol and GPB Global Resources, have discovered PDVSA appointed new joint venture managers or took over their operations.

GPB Global Resources, a minority stakeholder in the Petrozamora joint venture, in September lost access to its fields with no official explanation given by PDVSA, sources and workers said.

"They left without paying us completely," said a worker from Petrozamora who asked not to be identified, referring to GPB. "Days ago, an official passed by and said the company had not respected its contract with PDVSA."

Suelopetrol declined to comment on talks with PDVSA, but said the company remains committed to Venezuela, with assets and staff in place. GPB Global Resources did not reply to a request for comment.

With companies and workers leaving almost en masse, the abandonment of oilfields is visible near Maracaibo Lake, among Venezuela's oldest producing region. Its oil output keeps falling, outages became routine and some workers are on the verge of starvation.

"A month ago, they tried to restart a small rig and it caused an explosion than sent crude to people's houses," said a neighbor of Maracaibo's Cabimas oilfield, his feet stained with oil.

From over 110,000 workers a decade ago, PDVSA's workforce has dropped to about 60,000 people, said Daniel Delgado, a union leader at the Tia Juana oilfield.

"We are risking our lives to get an oil barrel out by working in unsafe conditions, without proper equipment or medical assistance. It's a high price," Delgado said.

Between 2019 and 2021, PDVSA delivered oil cargoes to partners to reduce outstanding debt.

Eni and Repsol this summer received 3.6 million barrels in a temporary resumption of oil-for-debt, but nothing since then. Chevron has proposed to the US government it be allowed to recoup its debts through an expanded license, yet pending.

"Almost none of the companies that have left the country have been given that benefit," said an oil industry representative, who declined to be identified.

The departures have hit oil service providers and contractors the hardest, said the Venezuelan Petroleum Chamber, whose members fell to 300 from 500 in the last four years.

Venezuela last year fell short of reaching its oil production goal. And so far this year output has stalled at about 725,000 barrels per day (bpd), well below its year-end target of 2 million bpd.

To further increase production would require PDVSA to honor past debts, said Enrique Novoa, the Chamber's president, adding: "Sanctions also must be eased, at least partially."

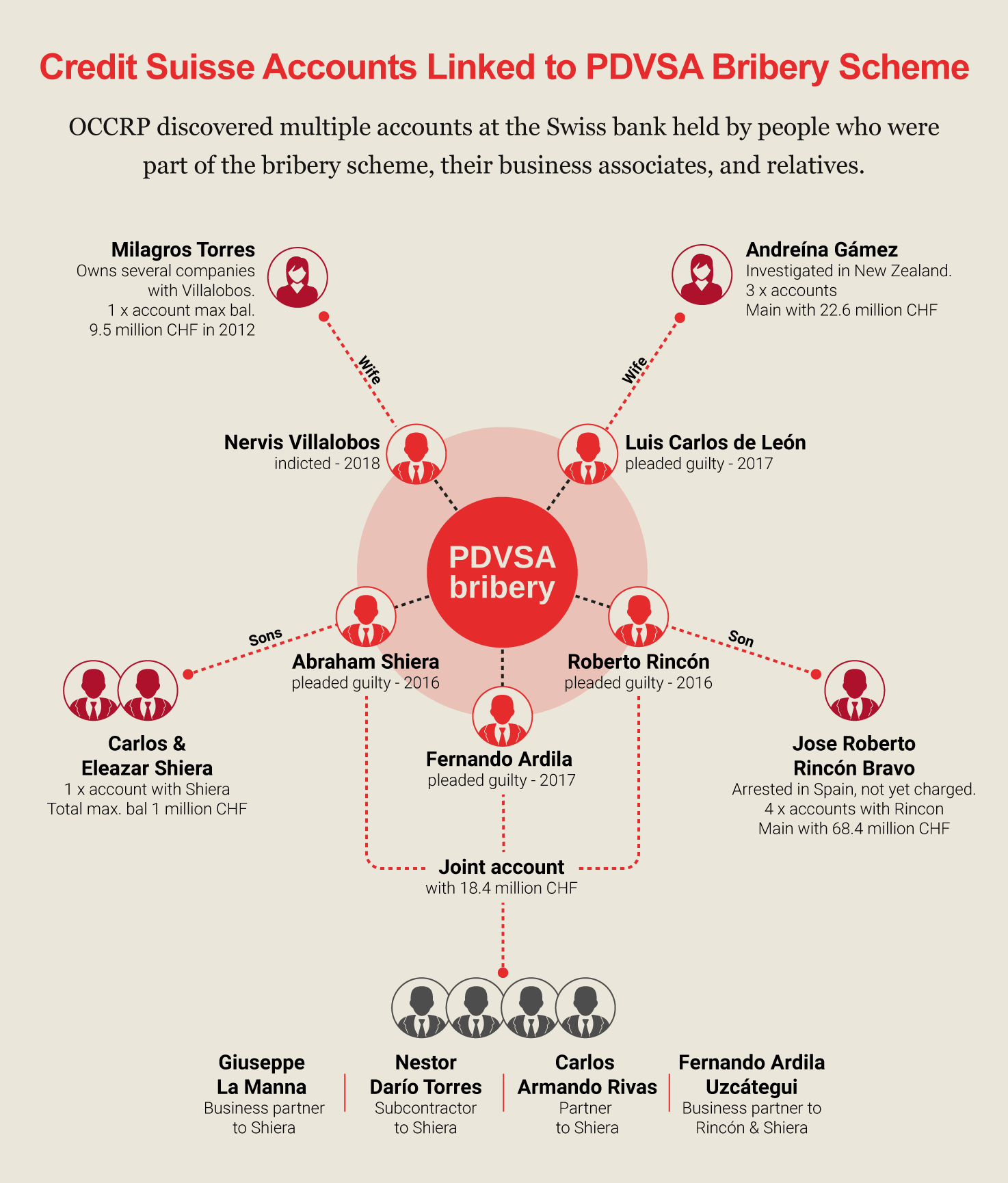

Black Gold in Swiss Vaults: Venezuelan Elites Hid Stolen Oil Money in Credit Suisse - OCCRP

Black Gold in Swiss Vaults: Venezuelan Elites Hid Stolen Oil Money in Credit Suisse - OCCRP