- The Global Oil Market Is Broken, Drowning in Crude Nobody Needs

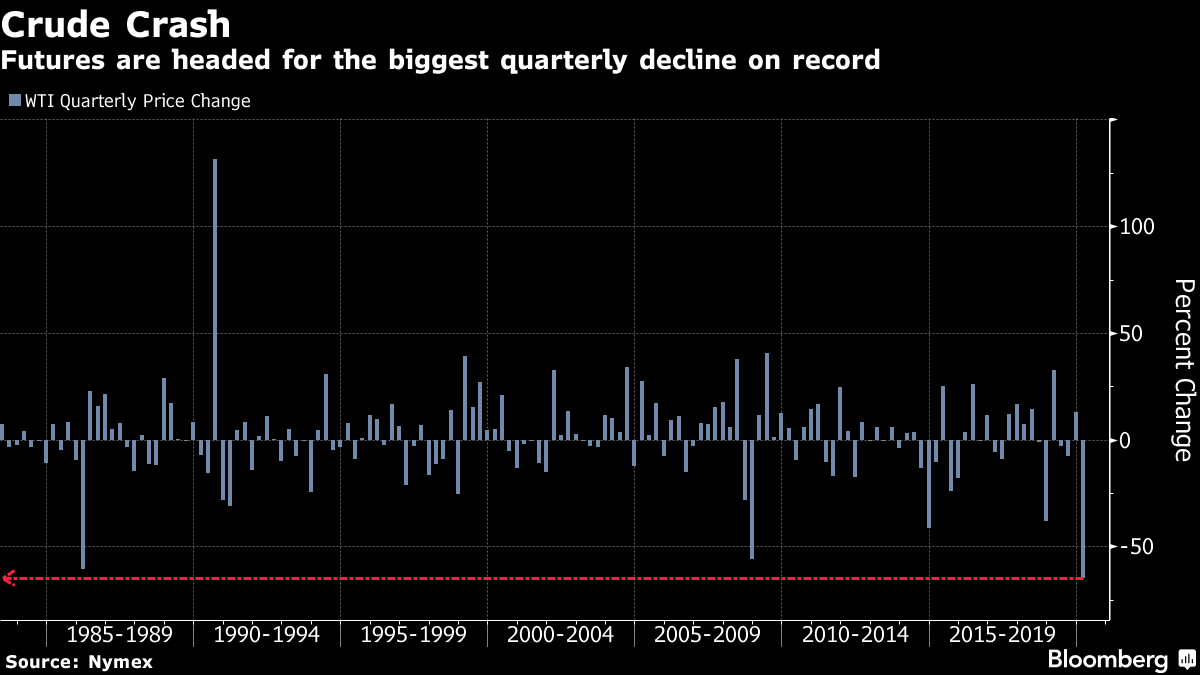

The global oil market is broken, overwhelmed by an unmanageable surplus as virus lockdowns cascade through the world's largest economies.

Onshore tanks in many markets are full, forcing traders to store excess oil in idle supertankers. Refineries are starting to shut down because nobody needs the fuels they produce. In physical oil markets, barrels are already changing hands for less than $10, and in a few landlocked markets producers are paying consumers to take away their crude.

"The physical oil market has seized up," said Gary Ross, an influential oil watcher and chief investment officer of Black Gold Investors LLC. "The logistics are struggling to cope because we are facing a catastrophic loss of demand."

Oil traders say it's likely to get worse this week.

The root cause is an accelerating plunge in consumption that's without precedent since a steady flow of oil became essential to the global economy more than a century ago. The great crash of 1929, the twin oil shocks of the 1970s and the global financial crisis don't come close. The world normally uses 100 million barrels of oil day, and traders and analysts reckon as much as a quarter of that has disappeared in just a few weeks.

The global airline industry is grounded, countless businesses and factories are shuttered and billions of people have been forced to stay home.

"Demand clearly is off, in some parts of the world, very dramatically," Chevron CEO Mike Wirth told Bloomberg TV.

The immediate problem is a lack of storage in the right places. With demand running 20 million barrels a day below supply, the world won't have enough tanks to store the surplus in two or three months.

Read the whole story here: https://www.bloomberg.com/news/articles/2020-03-29/the-global-oil-market-is-broken-drowning-in-crude-nobody-needs?sref=VxHCy32x