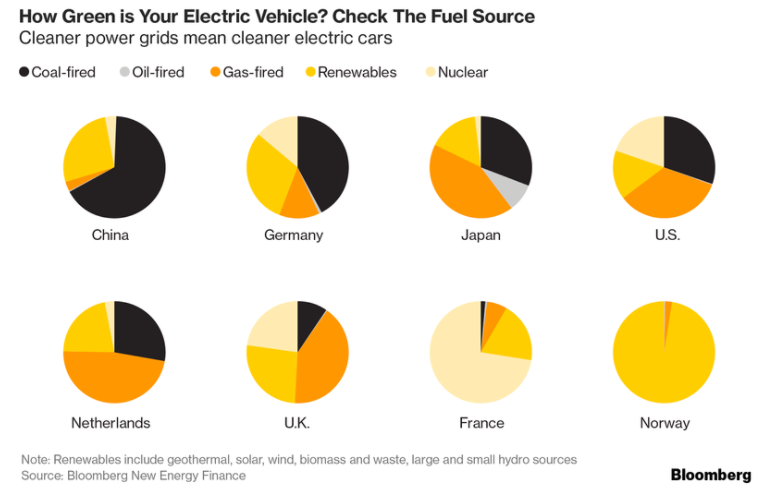

Though electric cars are greener than conventional ones, much of their power still comes from coal.

The surprising truth behind the world's electric cars

Image: REUTERS/Norihiko Shirouzu

The production and sale of electric vehicles accelerated in 2016, with two million cars manufactured and over 750,000 sold globally, according to the International Energy Agency's (IEA) 2017 Global Electric Vehicle report.

And the market is expected to boom further in the coming years. The report predicts electric car stocks will range from between nine million and 20 million by 2020 and between 40 million and 70 million by 2025. Countries around the world are also attempting to ban the sale of petrol and diesel cars, and are encouraging motorists to go green.

However, electric vehicles are not emissions-free. While these vehicles obviously run on electricity, that electricity typically comes from a mix of emissions-intensive fossil fuels, nuclear energy, and power from renewables. That is, unless you live in country like Norway, which generates virtually all of its electricity from hydropower. But Norway is the exception rather than the rule.