@WSJ reports talks are active, with BP “considering the approach carefully.” The industry has its doubts a deal will be done. Acquiring BP would put Shell more on par with its larger US competitors Exxon Mobil XOM & Chevron CVX.

Bloomberg & CNBC have reported that a deal for the whole company is unlikely, but the sale in parts could be on the table. ADNOC, the Abu Dhabi national oil company, is said to be a possible buyer of the parts as well, specifically BP’s LNG assets. Any deal by ADNOC is likely to be pursued through XRG, its international unit. ADNOC or XRG could also look at BP’s fuel retailing business, according to Bloomberg.

Potential terms of any deal couldn't be learned and a tie-up is far from certain, discussions moving slowly.

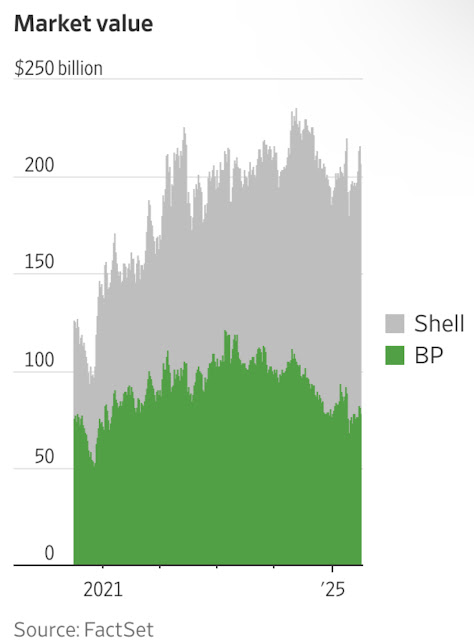

BP is currently valued at around $80 billion. Taking into account a premium, a deal could end up as the largest corporate oil deal since the $83 billion megamerger that created Exxon Mobil at the turn of the century. It would also easily be the biggest M&A deal of the year—so far.

John Paul Singer’s Eliott Management currently holds 5% of BP, and has been pressuring the company to do a deal.

Read the articles here:

CNBC: https://www.cnbc.com/2025/06/12/bp-takeover-speculation-uae-oil-giant-adnoc-enters-the-fray.html

No comments:

Post a Comment