Search This Blog

Saturday, December 15, 2018

Wednesday, December 12, 2018

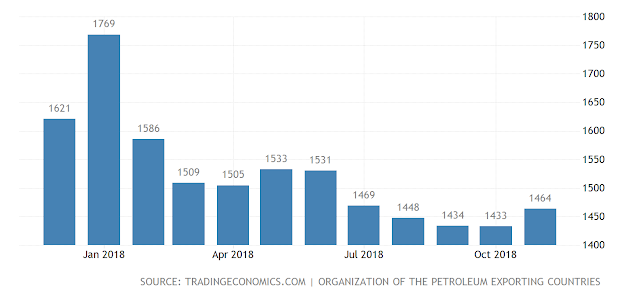

#Venezuela #Oil Production up 31k BOPD to 1.464 MM BOPD in November, #PDVSA #OOTT

Saturday, December 8, 2018

#USGS Announces Largest Continuous #Oil Assessment in #Texas & #NewMexico

Tuesday, December 4, 2018

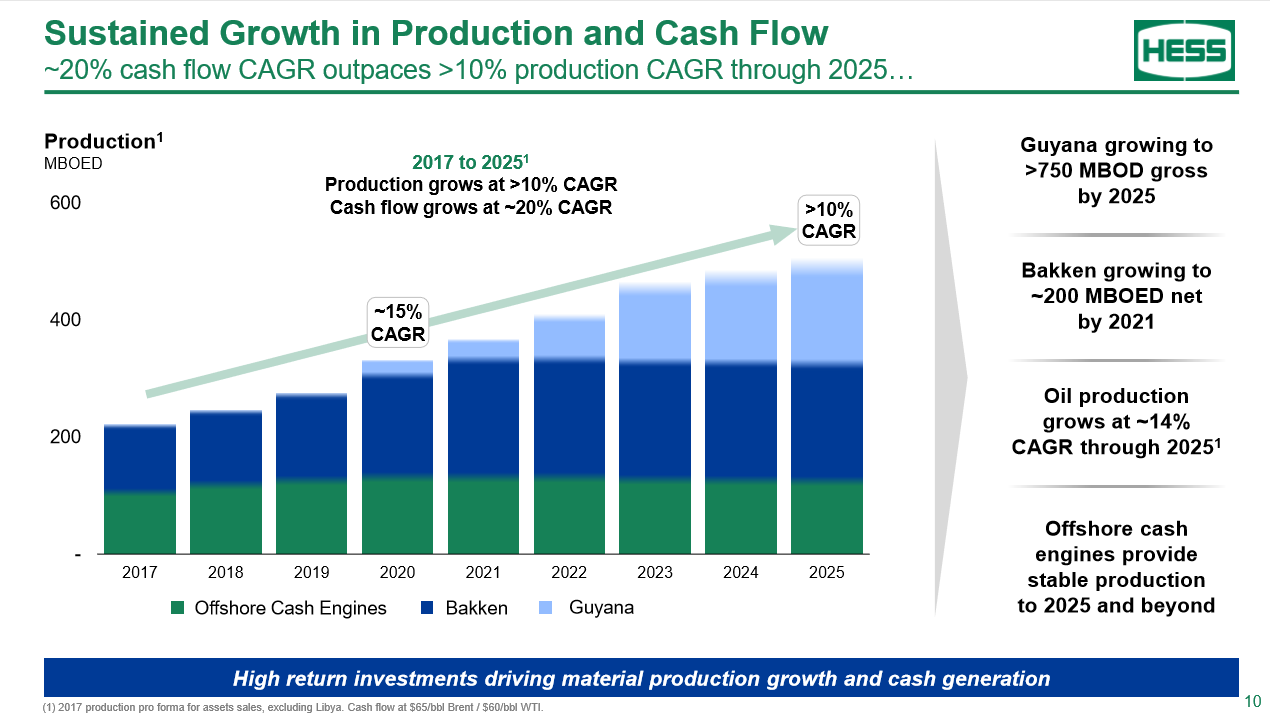

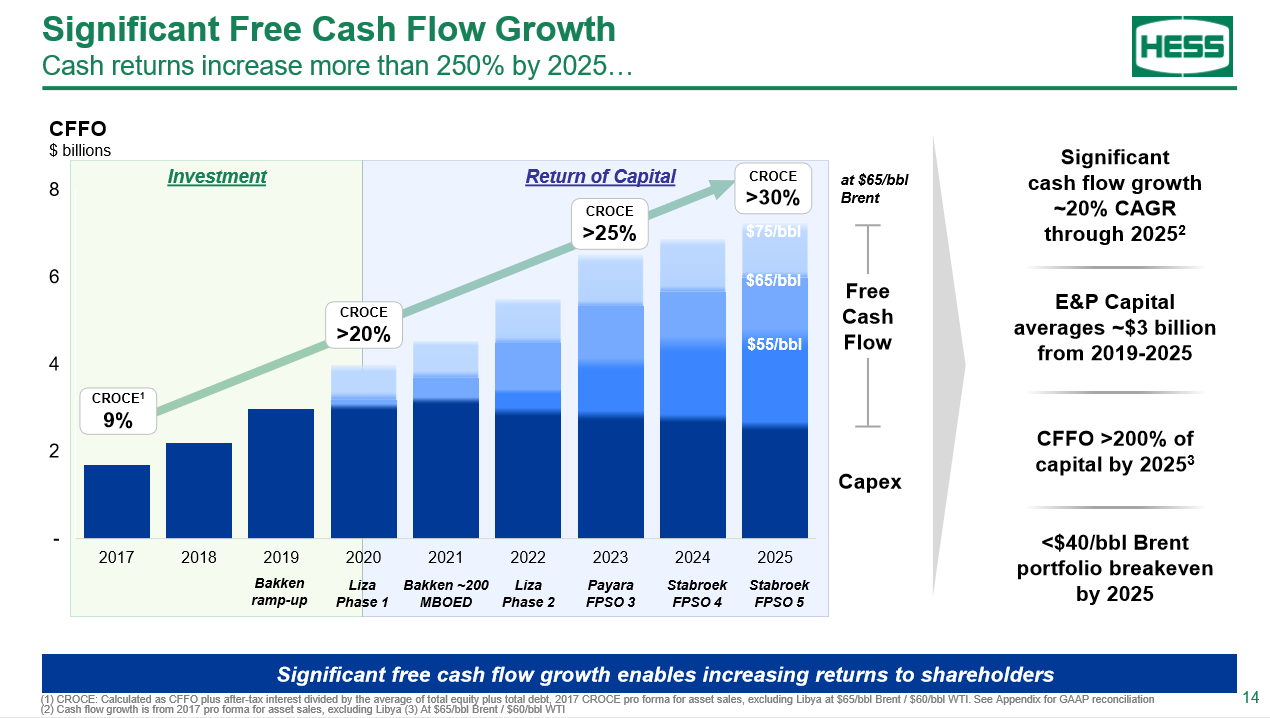

Forget #Venezuela, there’s #Guyana now! @ExxonMobil @Hess 5BN Barrels of #Oil @ #Stabroek in 4 years

- Reinforces potential for at least five floating storage, production and offloading vessels producing more than 750,000 barrels of oil per day by 2025

- Pluma-1 well represents 10th discovery

ExxonMobil Increases Stabroek Resource Estimate to 5 Billion Barrels; Makes 10th Discovery

- More than 5 billion recoverable oil-equivalent barrels discovered in less than four years

- Reinforces potential for at least five floating storage, production and offloading vessels producing more than 750,000 barrels of oil per day by 2025

- Pluma-1 well represents 10th discovery

IRVING, Texas--(BUSINESS WIRE)-- ExxonMobil said today it made its 10th discovery offshore Guyana and increased its estimate of the discovered recoverable resource for the Stabroek Block to more than 5 billion oil-equivalent barrels.

The resource estimate, up from the previous estimate of more than 4 billion oil-equivalent barrels, is a result of further evaluation of previous discoveries and includes a new discovery at the Pluma-1 well.

"The discovery of a resource base of more than 5 billion oil-equivalent barrels in less than four years is a testament of our technical expertise and rigorous evaluation and pursuit of high-potential, high-risk opportunities in this frontier area," said Neil Chapman, ExxonMobil senior vice president. "We will continue to apply what we've learned to identify additional exploration prospects and potential future discoveries that will deliver significant value to Guyanese people, our partners and shareholders."

The Pluma-1 well encountered approximately 121 feet (37 meters) of high-quality hydrocarbon-bearing sandstone reservoir. Pluma-1 reached a depth of 16,447 feet (5,013 meters) in 3,340 feet (1,018 meters) of water. The Noble Tom Madden drillship began drilling on Nov. 1. The well is located approximately 17 miles (27 kilometers) south of the Turbot-1 well. The Noble Tom Madden will next drill the Tilapia-1 prospect located 3.4 miles (5.5 kilometers) west of the Longtail-1 well.

"Together with the government and people of Guyana, we are continuing to grow the value of the Stabroek Block for Guyana, our partners and ExxonMobil with successful exploration investments," said Steve Greenlee, president of ExxonMobil Exploration Company. "Our ongoing work will evaluate development options in the southeastern portion of the block, potentially combining Pluma with prior Turbot and Longtail discoveries into a major new development area."

The Liza Phase 1 development is expected to begin producing up to 120,000 barrels oil per day by early 2020, utilizing the Liza Destiny floating storage, production and offloading vessel (FPSO). As previously announced, Liza Phase 2 is expected to start up by mid-2022. Pending government and regulatory approvals, Liza Phase 2 project sanction is expected in early 2019 and will use a second FPSO designed to produce up to 220,000 barrels per day. Sanctioning of a third development, Payara, is also expected in 2019 with start up as early as 2023.

The Stabroek Block is 6.6 million acres (26,800 square kilometers). ExxonMobil affiliate Esso Exploration and Production Guyana Limited is operator and holds 45 percent interest in the Stabroek Block. Hess Guyana Exploration Ltd. holds 30 percent interest and CNOOC Nexen Petroleum Guyana Limited holds 25 percent interest.

About ExxonMobil

ExxonMobil, the largest publicly traded international energy company, uses technology and innovation to help meet the world's growing energy needs. ExxonMobil holds an industry-leading inventory of resources, is one of the largest refiners and marketers of petroleum products, and its chemical company is one of the largest in the world. For more information, visit www.exxonmobil.com or follow us on Twitter www.twitter.com/exxonmobil.

Cautionary Statement: Statements of future events or conditions in this release are forward-looking statements. Actual future results, including project plans and schedules, resource recoveries and production rates could differ materially due to changes in market conditions affecting the oil and gas industry or long-term oil and gas price levels; political or regulatory developments including the grant of necessary approvals; reservoir performance; the outcome of future exploration and development efforts; technical or operating factors; the outcome of future commercial negotiations; and other factors cited under the caption "Factors Affecting Future Results" on the Investors page of our website at www.exxonmobil.com. References to oil-equivalent barrels and similar terms include quantities that are not yet classified as proved reserves under SEC rules but are expected ultimately to be moved into the proved reserve category and produced in the future.

View source version on businesswire.com: https://www.businesswire.com/news/home/20181203005259/en/

ExxonMobil

Media Relations, 972-940-6007

Source: Exxon Mobil Corporation (XOM)

Copyright Business Wire 2018Sunday, November 25, 2018

Over the last few years, Moscow has become Venezuela’s lender of last resort…

Exclusive: Rosneft's Sechin flies to Venezuela, rebukes Maduro over oil shipments

Over the last few years, Moscow has become Venezuela's lender of last resort, with the Russian government and Rosneft handing Venezuela at least $17 billion in loans and credit lines since 2006, according to Reuters calculations.

Sechin handed Maduro graphics about oil shipments to Russian entities compared with China, the two sources said.

Top financier China, which has ploughed more than $50 billion into Venezuela, also gets reimbursed in oil.

According to Reuters calculations based on PDVSA data, the Caracas-based company delivered around 463,500 bpd to Chinese firms between January and August, a roughly 60 percent compliance rate. That compares with around 176,680 bpd to Russian entities, or a 40 percent compliance rate.

Rosneft and PDVSA did not immediately respond to a request for comment.

One of the sources with knowledge of Sechin's visit, as well as two separate sources, said a Chinese delegation was also in Caracas this week.

As of early 2017, PDVSA began to fall months behind on shipments of crude and fuel under the loan deals with China and Russia due to problems in its oil industry, home to the world's biggest crude reserves, according to documents reviewed by Reuters.

The problems include operational mishaps, such as refining outages and delayed cleaning of tanker hulls, and financial disputes with service providers owed money by PDVSA.

This April, Rosneft and PDVSA signed a refinancing agreement designed to allow the Venezuelan company to catch up on delayed loan payments by delivering more crude to Rosneft. Under the refinancing, PDVSA has to provide Rosneft with some 380,000 bpd, up from around 310,000 bpd, according to Reuters calculations.

The Russian company was planning on using Jose's South dock to pick up the cargoes, before an August tanker collision delayed exports to Rosneft. PDVSA reopened the dock earlier this month, sources said.

China agreed to use ship-to-ship (STS) operations to avoid Venezuela's clogged ports. However, the clients to whom Rosneft sends Venezuelan crude, Russian-backed Indian refiner Nayara Energy and Indian conglomerate Reliance, did not agree to STS transfers, likely heightening delays.

Exclusive: Rosneft's Sechin flies to Venezuela, rebukes Maduro over oil shipments

Wednesday, November 21, 2018

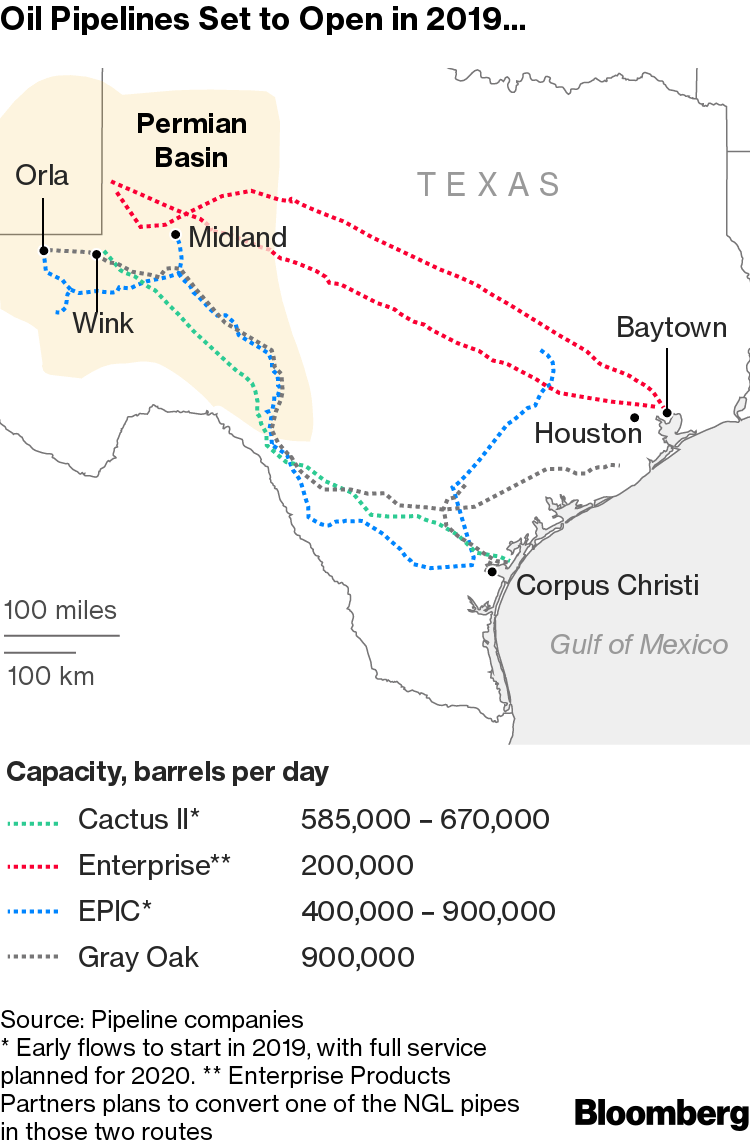

#Texas Is About to Create #OPEC's Worst Nightmare #Oil #OOTT

Texas Is About to Create OPEC's Worst Nightmare

In less than a decade, U.S. companies have drilled 114,000 wells. Many of them would turn a profit even with crude prices as low as $30 a barrel.

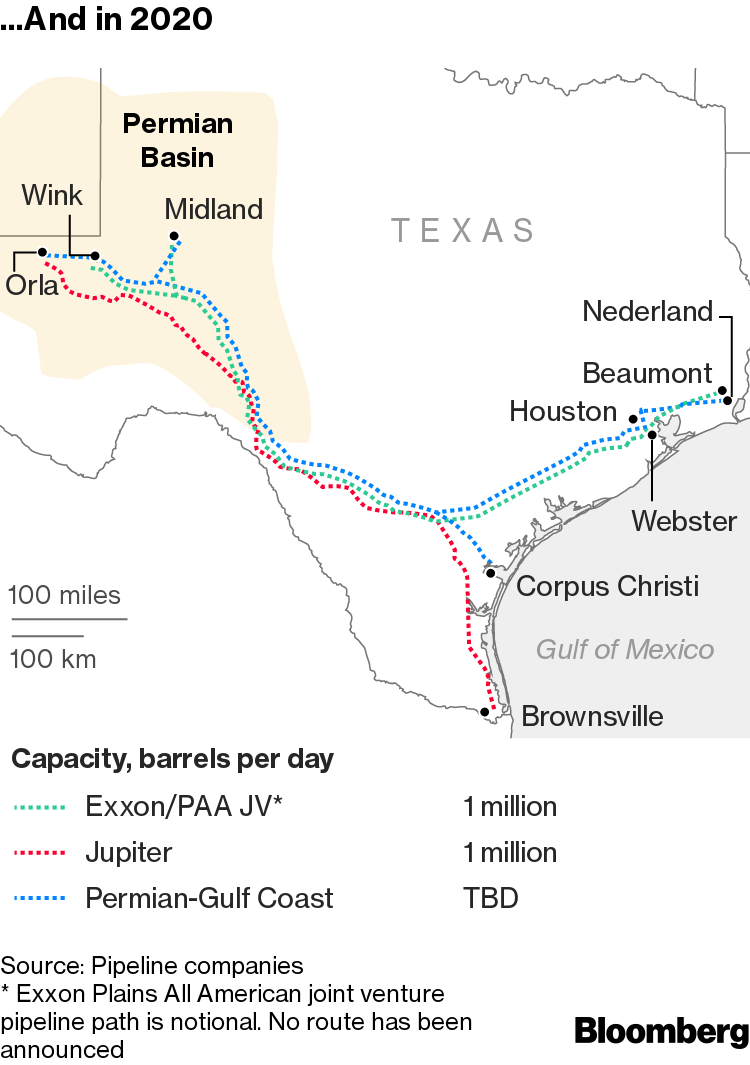

OPEC's bad dream only deepens next year, when Permian producers expect to iron out distribution snags that will add three pipelines and as much as 2 million barrels of oil a day.

"The Permian will continue to grow and OPEC needs to learn to live with it,'' said Mike Loya, the top executive in the Americas for Vitol Group, the world's largest independent oil-trading house.

The U.S. energy surge presents OPEC with one of the biggest challenges of its 60-year history. If Saudi Arabia and its allies cut production to keep prices higher, shale will thrive, robbing them of market share. But because the Saudis need higher crude prices to make money than U.S. producers, OPEC can't afford to let prices fall.

Cartel Squeezed

So the cartel finds itself squeezed between the-sky's-the-limit U.S. output and softer demand growth. The 15 members, and allies including Russia, Mexico and Kazakhstan, will discuss the possibility of their second retreat from booming American production in three years when they gather Dec. 6 in Vienna.

OPEC helped create the monster that haunts its sleep. After it flooded the market in 2014, oil prices crashed, forcing surviving U.S. shale producers to get leaner so they could thrive even with lower oil prices. As prices recovered, so did drilling.

Price Tumble

"You've got an awful lot of production that can come in very economically,'' said Patricia Yarrington, Chevron Corp.'s chief financial officer. "If you think back four or five years ago, when we didn't really understand what shale could do, the marginal barrel was priced much higher than what we think the marginal barrel is priced today.''

That shift makes shale resilient to a price tumble. After touching a four-year high in October, West Texas Intermediate, the U.S. benchmark, has fallen by more than 20 percent.

Only a few months ago, the consensus was that the Permian and U.S. oil production more widely was going to hit a plateau this past summer. It would flat-line through the rest of this year and 2019 due to pipeline constraints, only to start growing again -- perhaps -- in early 2020.

If that had happened, Saudi Arabia would've had an easier job, most likely avoiding output cuts next year because production losses in Venezuela and sanctions on Iran would have done the trick.

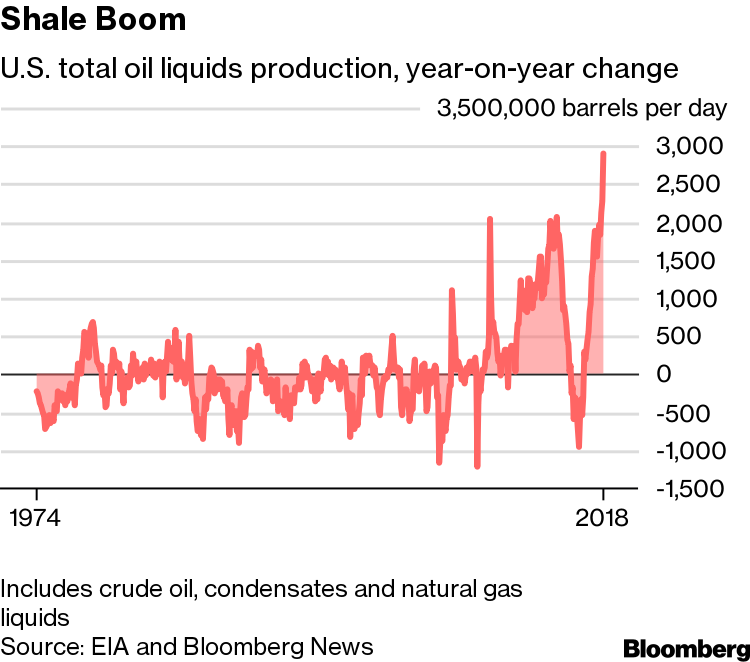

Instead, August saw the largest annual increase in U.S. oil production in 98 years, according to government data. The American energy industry added, in crude and other oil liquids, nearly 3 million barrels, roughly the equivalent of what Kuwait pumps, than it did in the same month last year. Total output of 15.9 million barrels a day was more than Russia or Saudi Arabia.

Read the rest of the story here: https://www.bloomberg.com/amp/news/articles/2018-11-21/opec-s-worst-nightmare-the-permian-is-about-to-pump-a-lot-more?

Sunday, November 4, 2018

Hammerhead-1, @ExxonMobil’s, @Hess’ 9th discovery in #Guyana, ‘thickest single sand package’ on #Stabroek Block

Hammerhead could jump the queue in terms of being ahead of some of the other phases on the Stabroek Block– Hess

November 1, 2018

The Hammerhead-1 well, where approximately 197 feet (60 meters) of high-quality, oil-bearing sandstone reservoir was encountered by the Stena Carron drillship in August offshore Guyana is the 'thickest single sand package' drilled on the Stabroek Block, according to President and Chief Operating Officer of Hess Corporation, Gregory P. Hill.

Hess has a 30 percent stake in the Stabroek Block where ExxonMobil affiliate Esso Exploration and Production Guyana Ltd. is operator with 45 percent interest and CNOOC Nexen has 25 percent.

Speaking on a 3rd quarter earnings call on Wednesday, Hill said Hammerhead is a massive accumulation and very thick sand package. "In fact, it's the thickest single sand package that we drilled on the block. It's a very large structure so it's going to require some additional appraisal. What we can say is that the results of the DST were good, meaning that the reservoir quality is excellent and the reservoir seems to be well-connected."

He was at the time responding to a question from Doug Leggate – Bank of America Merrill Lynch, who queried about the company's plans to potentially fast-track Hammerhead to development stage. Leggate also wanted to confirm that the Hammerhead discovery was an addition to the already estimated volume of more than 4 billion barrels of recoverable oil found on the block.

"You're right to say that Hammerhead's accretive to the 4 billion barrels and it could jump the queue in terms of being ahead of some of the other phases that were on the Turbot cluster, but it's too early to say that because we need some additional appraisal before we make that final decision. But, again, it is accretive to the 4 billion barrels," Hill said in response.

Hammerhead-1, which accounted for ExxonMobil's 9th discovery in Guyana, was safely drilled to 13,862 feet (4,225 meters) depth in 3,373 feet (1,150 meters) of water.

Friday, October 26, 2018

What do you want? #RenewableEnergy. When do you want it? Now!

100 percent renewables is a wildly popular goal

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13052251/eei_survey_2018_truths.jpg) EEI

EEI :no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13052265/eei_survey_2018_support.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13052261/eei_survey_2018_poll.jpg) EEI

EEI The Pangea Advisors Blog

Pangea on Twitter

Monday, October 1, 2018

Looking to create pure play #oil sands company, #Canada’s @HuskyEnergy offers 37% premium in hostile bid for @MEGenergyCorp $MEG.TO $HSE.TO

Still clearly cheaper to buy than to build in the oil sands.

Thursday, September 13, 2018

US is now the largest global crude #oil producer-EIA

The United States is now the largest global crude oil producer - Today in Energy

The United States likely surpassed Russia and Saudi Arabia to become the world’s largest crude oil producer earlier this year, based on preliminary estimates in EIA’s Short-Term Energy Outlook (STEO). In February, U.S. crude oil production exceeded that of Saudi Arabia for the first time in more than two decades. In June and August, the United States surpassed Russia in crude oil production for the first time since February 1999.

Although EIA does not publish crude oil production forecasts for Russia and Saudi Arabia in STEO, EIA expects that U.S. crude oil production will continue to exceed Russian and Saudi Arabian crude oil production for the remaining months of 2018 and through 2019.

U.S. crude oil production, particularly from light sweet crude oil grades, has rapidly increased since 2011. Much of the recent growth has occurred in areas such as the Permian region in western Texas and eastern New Mexico, the Federal Offshore Gulf of Mexico, and the Bakken region in North Dakota and Montana.

The oil price decline in mid-2014 resulted in U.S. producers reducing their costs and temporarily scaling back crude oil production. However, after crude oil prices increased in early 2016, investment and production began increasing later that year. By comparison, Russia and Saudi Arabia have maintained relatively steady crude oil production growth in recent years.

Saudi Arabia's crude oil and other liquids production data are EIA internal estimates. Russian data mainly come from the Russian Ministry of Oil, which publishes crude oil and condensate numbers. Other sources used to inform these estimates include data from major producing companies, international organizations (such as the International Energy Agency), and industry publications, among others.

Principal contributors: Candace Dunn, Tim Hess

Norwegian #Energy Trader blows €100m hole in @Nasdaq’s power market, swallowed 2/3 of #Derivatives exchange mutual default fund

"Nasdaq said the size of his positions blew through several layers of safeguards designed to protect the clearing house from hefty losses. Mr Aas was clearing his own trades, rather than going through a broker. Aside from having lost his initial margin on the trades, he will also lose the €36m he provided as additional margin as the trade soured.

That prompted Nasdaq to cut the entire trade on Wednesday and the exchange confirmed that the loss accounted for all of the exchange’s own default fund of €7m and swallowed €107m, or two-thirds, of its €166m mutual default fund that clearing house members must contribute to."

Trader blows €100m hole in Nasdaq’s Nordic power market: Loss raises questions over clearing-house controls on eve of Lehman anniversary

Monday, September 3, 2018

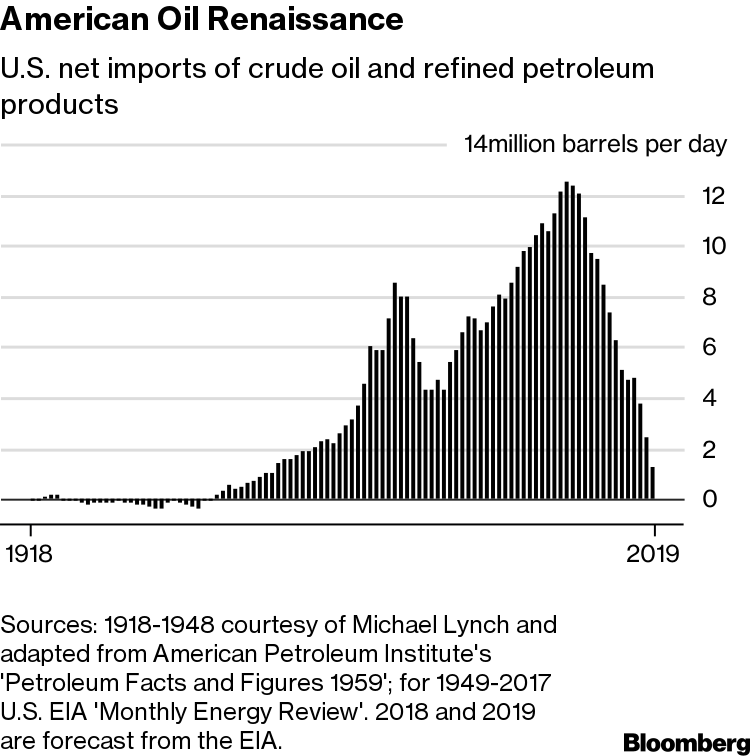

This is why the #USA just doesn’t care too much about #Venezuela .. #Oil #OOTT @EIAgov

This is why the #USA just doesn’t care too much about #Venezuela .. #Oil #OOTT #MasterEnergy @EIAgov pic.twitter.com/q53qmBYHxT— MasterEnergy (@MasterEnergyRSS) September 3, 2018

Tuesday, June 19, 2018

#PDVSA: #Venezuela's near collapse takes toll on #oil industry Platts

https://www.platts.com/latest-news/oil/newyork/factbox-venezuelas-near-collapse-takes-toll-on-21093950

Factbox: Venezuela's near collapse takes toll on oil industry

New York (Platts)--18 Jun 2018 600 pm EDT/2200 GMT

Venezuela's near economic collapse has taken a toll on the country's oil production, causing shifts in oil flows as buyers look to secure alternative supplies.

As workers have fled the country, state-owned oil company PDVSA has had a difficult time maintaining crude output, let alone boosting production. PDVSA's refining sector has also deteriorated on a lack of funds and manpower.

PDVSA has had difficulty pulling crude from storage because its supplies are subject to seizure by creditors. Most notably, on April 26 the International Trade Court ordered PDVSA to pay $2.04 billion to ConocoPhillips for the 2007 expropriation of ConocoPhillips' 50.1% interest in its Petrozuata joint venture in PDVSA, and its 40% stake in the Hamaca project, both of which were heavy oil installations in the Orinoco Belt of eastern Venezuela.

And US has sanctioned individuals in Venezuela, including President Nicolas Maduro, prohibited the purchase and sale of any Venezuelan government debt, including any bonds issued by PDVSA, and banned the use of the Venezuela-issued digital currency known as the petro.

Below are some key takeaways from the current situation.

CRUDE OUTPUT, EXPORTS FALLING

* Venezuela crude production could be on the verge of sinking to 1 million b/d, and a drop in crude exports is causing a shift in trade flows.

* Venezuela's crude output averaged 1.36 million b/d in May, down from 1.41 million b/d in April, and 1.9 million b/d in May 2017, according to S&P Global Platts. The International Energy Agency said it could fall to 800,000 b/d or even lower next year.

* S&P Global Platts Analytics sees Venezuelan production remaining above 1 million b/d during 2019. "They have a certain amount of production that they can keep going although the heavier grades would get impacted if they can no longer buy diluents," said Chris Midgley, head of Platts Analytics.

* In early June, PDVSA notified 11 international customers that it would not be able to meet its crude supply commitments in full, a PDVSA official said. It is contractually obliged to supply 1.495 million b/d to these customers in June, but only has 694,000 b/d available. The customers either would not comment, or could not be reached for comment.

* Venezuela's rig count has fallen to 28 in May from 36 in April, and 49 in January, according to Baker Hughes International Rig Counts.

* PDVSA has experienced similar drops in the past. In the 1980s, the number of rigs fell to less than 30, causing crude production to fall to 1.3 million b/d.

* Production has slowed largely because of a lack of maintenance and as skilled employees have fled the country. For instance, PDVSA Friday was operating its 202,000 b/d Petrocedeno extra heavy crude upgrader at just 39.6% of capacity, due to delayed maintenance, lack of spare parts, and electrical failures, according to an operator at the facility.

* PDVSA's three other upgraders -- the 120,000 b/d Petrosanfelix, 120,000 b/d Petromonagas and 190,000 b/d Petropiar upgraders -- are expected to be operating below capacity in June.

* PDVSA planned to build a 200,000 b/d upgrader at an estimated cost of $5 billion-$6 billion in the PetroCarabobo project. However, India's ONGC Videsh has put on hold plans to invest in the upgrader until it has received full payment for its equity oil sales.

SHIFTING CRUDE FLOWS

* US Gulf Coast refiners have been increasing their imports of Canadian and Iraqi crude, likely making up for the Venezuelan shortage. * US Gulf Coast imports of Venezuelan heavy sour crude have averaged roughly 249,100 b/d so far this year, down from nearly 529,760 b/d in the same period in 2017 and 658,600 b/d in 2016.

* Iraq, which had long blended its heavier sour crude with medium grades, exported 301,600 b/d of heavy crude to the US Gulf Coast in March, according to the latest EIA data. It was the highest average since January 2017, when about 341,650 b/d of Iraqi heavy sour crude was shipped to the Gulf Coast, an all-time high, according to the EIA data. * Through May, roughly 35.5 million barrels of Basrah Heavy crude had been imported by US Gulf Coast refiners, up about 1 million barrels compared with the first five months of 2017, but more than double imports in the same time period in 2016, according to the latest US Customs and Border Protection data.

* Canadian crude producers are of late stepping up supplies to the US Gulf Coast, with the bulk of the increase being shipped on rail cars.

* Crude exports to the USGC are currently around 530,000 b/d, said Dinara Millington, vice president of research with the Canadian Energy Research Institute said Thursday in Calgary. That's up from 443,000 b/d in March, and 336,000 b/d in January 2017, according to EIA data.

* Canadian crude is competitive because of deep price discounts. The Western Canadian Select coking margin on the USGC has averaged $21.29/b so far in June, compared to a $5.94/b margin for Mexican Maya. The bulk of that WCS advantage comes from the deep spot price discounts for the grade.

* China's independent refiners are looking for alternative sources of heavy crude, with Mexican Maya, Colombia's Castilla and Canadian Cold Lake Blend options being considered.

* Independent refiners are major buyers of Venezuelan crudes, taking around 69% of the Latin American shipment to China, mainly through CNPC, which is the solo buyer under the oil-for-loan deal between the countries. China imported 4.7 million mt crude from Venezuela in Q1, out of which 3.22 million mt was taken by the independent refiners, data from the General Administration of Customs and S&P Global Platts showed.

* Venezuelan crudes are mainly used for asphalt production in China, the demand for which peaks over September-November.

* A CNPC source said it is difficult to find good alternatives for Venezuelan Merey crude, which with an API of 16 degrees and 2.46% sulfur content is a good feedstock for asphalt production. Some heavy crudes, like Maya from Mexico, can be used as an alternate to produce asphalt, a source with independent Wonfull Petrochemical said. But no crudes have been imported from Mexico by independent refineries since 2016.

REFINED PRODUCTS IMPORTS

* Venezuela's imports of oil products have been rising as output from its refineries has been declining due to lack of crude feedstock, accidents, unscheduled shutdowns, and delays in maintenance of various facilities.

* PDVSA will process just 499,000 b/d of crude at its domestic refineries in June, accounting for just 31% of its 1.6 million b/d of refining capacity. This would be 144,000 b/d lower from the same month in 2017.

* PDVSA's system is comprised of five refineries: Amuay, Cardon, El Palito, Puerto La Cruz, and Isla, which it operated in an agreement with the Curacao government. The government of Curacao is open to a third party operating the PDVSA-run Isla refinery.

* PDVSA plans to import 9.735 million barrels of oil products in June, up from 6.188 million barrels in May, and the highest since 2016, according to an internal PDVSA report seen by S&P Global Platts.

* PDVSA sources its imports from Russia's Rosneft, India's Reliance Industries Ltd., and Citgo, PDVSA's US-based refining arm.

* The decline in refinery utilization has also forced PDVSA to suspend oil product exports to eight countries in the Caribbean as part of its long standing Petrocaribe agreement. PDVSA has indefinitely suspended delivery of 38,000 b/d of oil products to Antigua and Barbuda, Belize, Dominica, El Salvador, Haiti, Nicaragua, San Vicente and St Kitts.

--Staff report, jeff.mower@spglobal.com

--Edited by Richard Rubin, newsdesk@spglobal.com